As a customer of Bank of America that do a lot of wire transfers, its quite pertinent to know the banks wire transfer limits. Because wire transfers reign supreme as the preferred means to transmit funds expeditiously and securely. Bank of America, an esteemed titan in the realm of financial institutions, extends a formidable wire transfer service. Yet, what boundaries encircle these financial conduits at Bank of America, and how do they exert influence on your fiscal undertakings? Join us on an expedition as we demystify this pivotal facet of banking.

Understanding of Wire Transfers In Bank Of America

Before we immerse ourselves in the particulars of Bank of America’s wire transfer thresholds, it’s imperative to construct a foundational comprehension of wire transfers. And you can read more about Bank Of America wire transfer fees international

The Genesis of a Wire Transfer

A wire transfer, an electronic avenue for transferring funds from one financial entity to another, emerges as a means of secure and swift monetary exchange, whether on a domestic or international scale. This method use many applications, from facilitating commercial transactions to facilitating personal remittances.

The Mechanics of Wire Transfers

The essence of a wire transfer revolves around the sender instigating the transfer by providing their bank with specific credentials concerning the recipient’s financial institution. This typically includes the recipient bank’s nomenclature, routing cipher, and the recipient’s account denomination. Subsequently, the sender’s financial institution orchestrates the movement of funds to the recipient’s bank, where they are seamlessly ascribed to the recipient’s account. Please you can read more about Bank of America wire transfer fees international

Encroaching upon Bank of America Wire Transfer Limits

Bank of America beckons its patrons with the allure of wire transfers, a convenience par excellence. However, it is imperative to familiarize oneself with the confines encapsulating this service.

1. Boundaries in the Realm of Domestic Wire Transfers

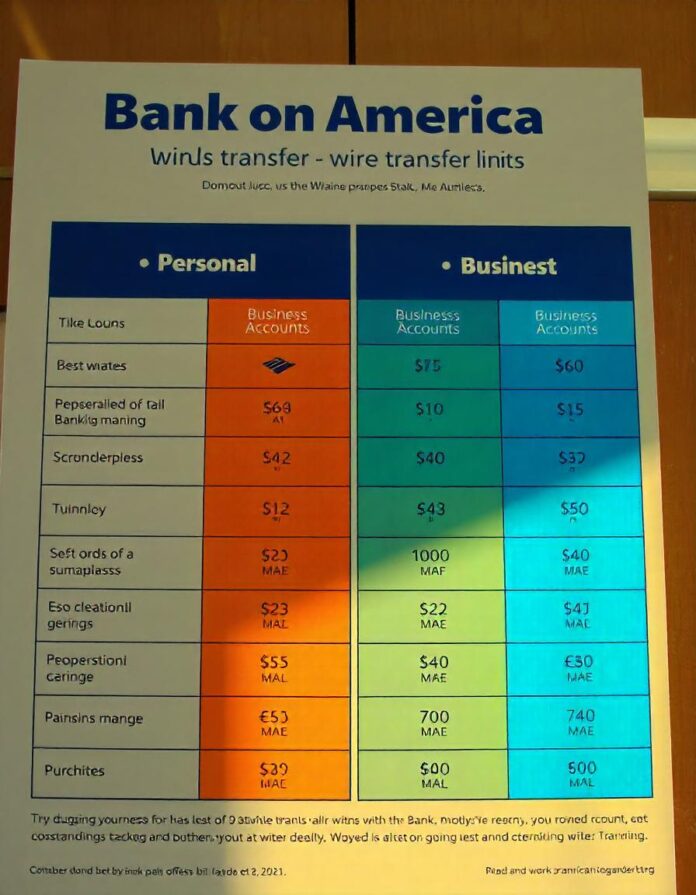

For the precinct of domestic wire transfers, Bank of America levies specific demarcations:

- Egress of Capital via Wire Transfers: Habitually, Bank of America’s clientele can dispense funds via online banking up to a zenith of $250,000 per diurnal business cycle. Nevertheless, this quota may oscillate contingent on the account category and the nuances inherent to the transaction.

- The Influx of Funds through Wire Transfers: In the echelons of inbound wire transfers, there prevails a dearth of imposed limitations, rendering the acceptance of monetary influx from diverse origins an unrestricted prerogative.

2. Parameters Governing International Wire Transfers

In the precincts of international wire transfers, the boundaries might assume a distinct countenance:

- Egress of Capital via Wire Transfers: Online acolytes of Bank of America typically possess the wherewithal to dispatch funds to most global destinations, with a threshold of $5,000. Nonetheless, some nations may proffer more frugal thresholds, dictated by regulatory exigencies. In instances mandating the transmittance of a more substantial sum, recourse to a local branch might be the expedient course of action.

- The Influx of Funds through Wire Transfers: Analogous to domestic transactions, inbound international wire transfers find themselves emancipated from restrictions, rendering the recipient’s ambit capacious and untrammeled.

Determinants Influencing Wire Transfer Boundaries

An amalgam of variables is known to sway the contours of wire transfer limits at Bank of America:

- The Nature of the Bank Account: The nomenclature of your bank account, whether a personal checking account or a commercial entity’s account, may cast its shadow upon the boundaries that apply to your wire transfers.

- The Modality of Transaction: The execution of a wire transfer, be it through the virtual confines of an online interface, the nimbleness of a mobile application, or the physical precincts of a bank branch, can inordinately shape the expanse of the limitations.

- The Destination on the Global Atlas: The geographical endpoint of international wire transfers is not bereft of statutory dicta that have a bearing on the permissible quantum of the transaction.

Maximizing the Edifice of Your Wire Transfer Experience

Now that the parameters demarcating wire transfer limitations at Bank of America stand elucidated, here are a slew of strategems to optimize your interface with this facility:

- Vet the Veracity of Particulars: The veracity of the recipient’s particulars, including bank credentials, warrants an assiduous audit to ensure the unimpeded transit of funds.

- A Prelude to Financial Conduits: For those whose monetary transfers traverse sizable expanses, meticulous planning is de rigueur. Be mindful of potential temporal protraction stemming from international regulations.

- Fraternal Liaison with Customer Service: In instances permeated by queries or necessitating the aegis of Bank of America’s wire transfer acumen, do not shrink from invoking the precincts of customer service, where sagacious counsel awaits with open arms.

Denoucement

Bank of America’s wire transfer apparatus unfurls an edifice of veritable dependability and efficiency, whether it’s the orchestration of commercial transactions or the transmission of pecuniary succor to kith and kin. Assiduously apprehending the precincts of wire transfer restrictions proves tantamount to ensuring the untrammelled flow of your financial machinations. Empowered with this erudition, you can navigate the labyrinthine trails of wire transfers with dauntless aplomb and harness this invaluable financial instrument to its fullest.

Curious about wire transfers or seeking guidance? Contact Bank of America without ado, as their dedicated corps stands poised to extend their helping hand.

Frequently Posited Questions On Bank Of America Transfer Limit

1. What precisely constitutes a wire transfer?

- A wire transfer constitutes a mode of electronic fund transmission. Thereby, enabling the seamless and swift relocation of monetary assets from one financial institution to another.Whether on the domestic or international scale.

2. What parameters govern the limits of domestic wire transfers at Bank of America?

- Bank of America generally permits its patrons to dispatch financial resources up to $250,000 per diurnal business cycle, courtesy of the online banking platform. Nonetheless, these confines may exhibit variability contingent on the specific classification of the account and the concomitant characteristics of the transaction.

3. Do boundaries restrict the inflow of resources via wire transfers at Bank of America?

- In the sphere of inbound wire transfers, limitations recede into the background, affording a plenitude of latitude for the embracement of financial inflow from an assortment of sources, free from fetters.

4. What determinants play a role in shaping wire transfer thresholds at Bank of America?

- The contours of wire transfer limits are liable to distortion by a trifecta of considerations: the genre of the bank account, the modality of the financial transaction, and the geographical destination in the global tapestry of nations.

5. How can one access the wealth of sagacity and support proffered by Bank of America Customer Support in matters concerning wire transfers?

- Should inquiries percolate or situations necessitate the compass of Bank of America’s