In a financial pinch, the allure of “instant payday loans online with guaranteed approval” can feel like a lifeline. These loans promise quick cash without the hassle of credit checks or lengthy approval processes. But what’s the reality behind the convenience? While they might solve immediate problems, they can also lead to significant risks.

In this blog, we’ll explore the world of instant payday loans, share real-life stories, and offer actionable advice to help you make informed borrowing decisions.

What Are Instant Payday Loans Online?

Instant payday loans online are short-term loans designed for emergencies. These loans are marketed as quick, hassle-free solutions, offering same-day cash deposits with little to no background checks.

Key Features:

- Loan Amounts: Typically $100–$1,000.

- Repayment Terms: Usually 2–4 weeks.

- Approval Speed: Often processed within minutes, with funds available the same day.

- High Interest Rates: APRs can exceed 300%.

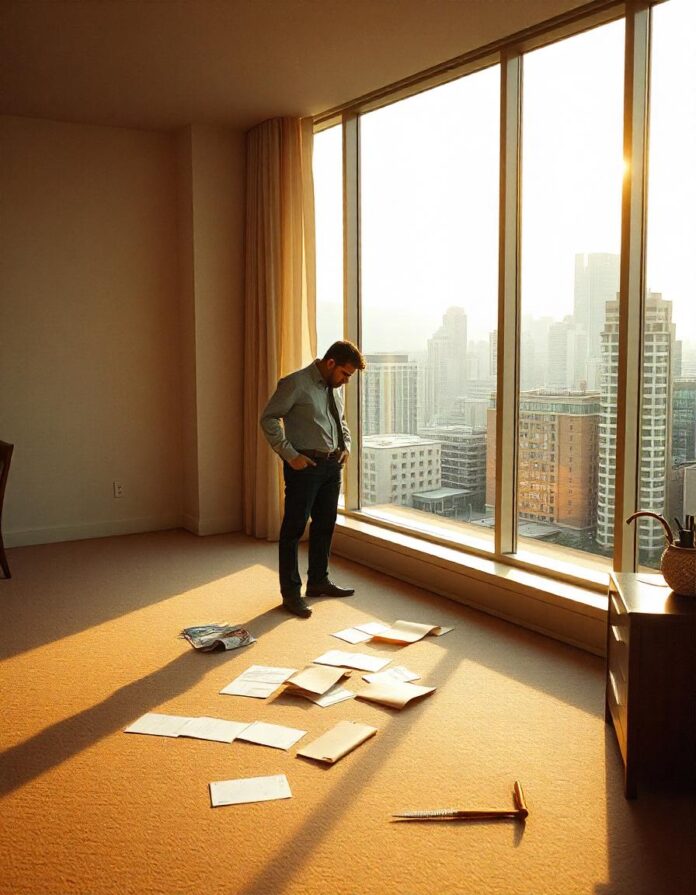

Storytime: Mike’s Experience with Instant Payday Loans

Mike, a 31-year-old delivery driver, needed $800 to cover a medical emergency. After searching online, he found a lender advertising “instant payday loans guaranteed approval.” The process was seamless, and Mike received the funds within hours.

Two weeks later, Mike owed $1,040, including a $240 fee. Unable to repay, he rolled over the loan, incurring another $240 fee. Within three months, Mike had paid $720 in fees but still owed the original $800.

How Instant Payday Loans Work

- Application Process

Borrowers fill out an online application, providing proof of income, a valid ID, and a bank account. - Approval

Approval is almost immediate, as no credit check is required. - Funds Disbursement

Once approved, the loan amount is deposited into the borrower’s bank account, often within hours. - Repayment

The loan, plus fees, is automatically withdrawn from the borrower’s account on the due date.

The Risks of Instant Payday Loans

1. High Fees and Interest Rates

The cost of borrowing can be astronomical, often leaving borrowers worse off financially.

Example Cost:

- Loan Amount: $500

- Fee: $15 per $100 borrowed = $75

- Total Repayment: $575

- APR: 391%

2. Debt Cycles

Borrowers who can’t repay on time often roll over their loans, leading to additional fees and a cycle of debt.

3. Predatory Practices

Some lenders exploit borrowers by offering unclear terms or hidden fees.

4. No Credit Building

Since payday loans aren’t reported to credit bureaus, they don’t help improve your credit score. Learn more about payday loan risks at CFPB. and at business standard

Infographic Idea: The True Cost of Instant Payday Loans

Title: “How a $500 Loan Can Cost You $2,000”

| Loan Scenario | Fees Paid | Total Owed | APR |

|---|---|---|---|

| Initial Loan | $75 | $575 | 391% |

| 1 Rollover | $150 | $650 | 391% |

| 3 Rollovers | $300 | $800 | 391% |

Alternatives to Instant Payday Loans

Before turning to payday loans, consider these safer options:

1. Credit Union Loans

Credit unions offer small-dollar loans with reasonable interest rates and better repayment terms.

2. Employer Advances

Some employers provide paycheck advances to employees in need.

3. Personal Loans

Banks and online lenders offer personal loans with significantly lower APRs and longer repayment periods. Compare personal loans at NerdWallet.

4. Emergency Savings

Building a financial cushion can help you avoid borrowing in the future.

How to Borrow Responsibly

If you decide an instant payday loan is your only option, follow these tips:

- Borrow Only What You Need

Avoid taking out more than you absolutely require to minimize fees. - Understand the Terms

Carefully read the fine print, including fees, repayment dates, and rollover policies. - Create a Repayment Plan

Budget carefully to ensure you can repay the loan on time without rolling it over. - Research the Lender

Choose a reputable lender by checking reviews and verifying their license.

Reflection Questions

- Have you ever used an instant payday loan? What was your experience?

- What steps can you take to build a financial safety net for emergencies?

- Are there alternative borrowing options available to you?

Conclusion: Convenience Comes with Costs

Instant payday loans offer quick cash, but their high costs and risks make them a last resort. By understanding how they work and exploring safer alternatives, you can make better financial decisions and avoid falling into debt traps.

Have you tried an instant payday loan? Share your story in the comments below. Don’t forget to share this guide with someone who might find it helpful!