When it comes to understanding where your money truly stands, there is need for a personal financial statement template. This essential document shows your complete financial position—what you own, what you owe, and how much you’re really worth.

Whether you’re applying for a loan, planning your financial future, or simply trying to stay organized, using a financial statement template can transform the way you manage your finances. It helps you see patterns, find opportunities for improvement, and make better decisions with confidence.

What Is a Personal Financial Statement Template?

A financial statement template is a pre-formatted tool, often in Excel, Google Sheets, or PDF, that lets you list your assets, liabilities, income, and expenses. It calculates your total net worth automatically, showing the difference between what you own and owe. Think of it as a mirror that reflects your true financial health at any given time. Individuals use it to track progress, while lenders or financial advisors use it to assess creditworthiness. By keeping your information up-to-date in a personal financial statement template, you’ll always know your financial position in real time.

Why You Need a Personal Financial Statement Template

Everyone—from recent graduates to seasoned entrepreneurs—can benefit from a personal financial statement template. It helps you organize your finances in one place, monitor debt levels, and set achievable goals. If you’re trying to buy a house, invest, or start a business, lenders will often ask for a current financial statement. Having one ready saves time and shows professionalism. According to Forbes Advisor, tracking your finances regularly leads to smarter budgeting and stronger decision-making, both personally and professionally.

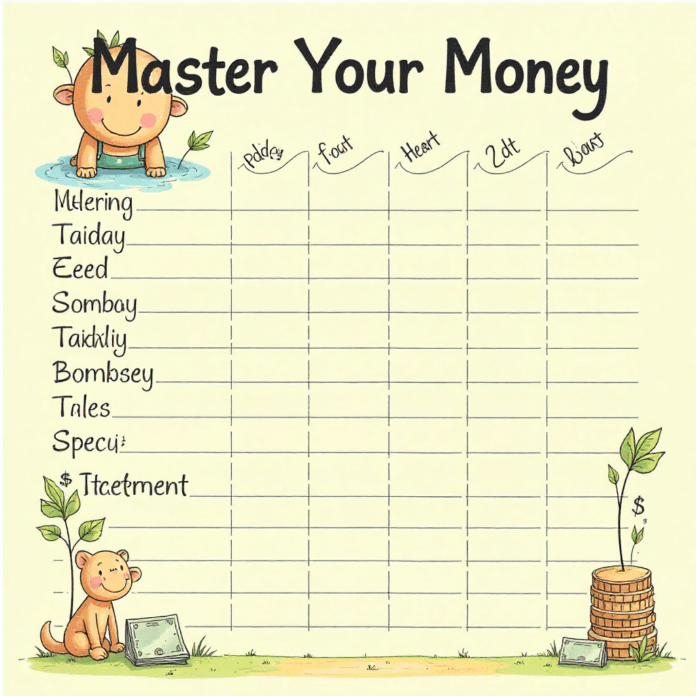

The Core Components of a Personal Financial Statement Template

A well-structured personal financial statement template includes several core components that make it useful and complete.

- Personal Information: Your name, contact details, and statement date.

- Assets: Cash, savings, investments, real estate, vehicles, and valuables.

- Liabilities: Credit card debts, loans, mortgages, and other obligations.

- Net Worth: Assets minus liabilities.

- Income and Expenses: Monthly or yearly cash inflows and outflows.

Each part plays a vital role in helping you understand your finances. Together, they create a full financial snapshot that helps guide your decisions.

How to Create a Personal Financial Statement Template

Building your own personal financial statement template can be simple if you know where to start. You can use Excel, Google Sheets, or download one from trusted platforms such as Vertex42 or Smartsheet. Begin with two main columns—one for assets and one for liabilities. Under assets, list everything valuable you own. Under liabilities, record what you owe. Add formulas that automatically calculate totals and subtract liabilities from assets to determine your net worth. You can also customize your template to include categories such as business investments or personal loans.

Understanding Assets in a Personal Financial Statement Template

When filling out the personal financial statement template, start with your assets. Assets represent the things that bring value or can be converted to cash. These include bank balances, stocks, retirement funds, vehicles, and real estate. It’s important to record accurate, realistic values for each item—overestimating could distort your financial picture. Regularly updating your assets in your personal financial statement template helps you stay aware of how your wealth changes over time and which investments are performing best.

Understanding Liabilities in a Personal Financial Statement Template

Liabilities are just as important to record in your personal financial statement template. They include credit card balances, student loans, car loans, and mortgages. This section shows what you owe to others. By comparing liabilities against your assets, you can calculate your true net worth. Reducing liabilities over time is one of the best ways to improve your financial health. The personal financial statement template helps highlight which debts cost you the most so you can prioritize paying them down strategically.

Calculating Net Worth with a Personal Financial Statement Template

Your net worth is a simple but powerful figure in any personal financial statement template. It’s calculated by subtracting total liabilities from total assets. A positive net worth means you own more than you owe; a negative one indicates the opposite. Tracking this number regularly reveals whether your financial habits are leading you in the right direction. Many people use their personal financial statement template as a progress chart—updating it monthly or quarterly shows tangible growth and helps you set realistic goals.

How a Personal Financial Statement Template Helps You Budget

A personal financial statement template can also double as a budgeting tool. Once you know your net worth and spending patterns, you can adjust your budget to allocate more toward savings or debt reduction. Reviewing the income and expense section of your financial statement template reveals areas where you might overspend. You can then create a more disciplined approach to managing your money. As NerdWallet points out, understanding your spending trends is key to achieving financial balance.

Using a Personal Financial Statement Template for Loan Applications

When you apply for a loan, financial institutions often request a personal financial statement template. It helps them assess your ability to repay. A clear, well-maintained statement shows your income stability and responsible financial management. For business owners, submitting this document builds credibility with lenders. Keeping your financial statement template updated ensures that you can respond quickly to loan requests without scrambling to gather information.

The Role of a Personal Financial Statement Template in Financial Planning

A personal financial statement template plays a crucial role in long-term financial planning. It gives you the data you need to evaluate your progress toward retirement, investments, or emergency savings. Reviewing it regularly helps identify gaps or risks—such as too much debt or insufficient savings. It’s also a great tool for your financial advisor, who can use it to recommend tailored strategies. Using a financial statement template ensures you make informed, data-driven decisions about your money. Please read on to learn more about personal financial planning.

How Couples Can Use a Personal Financial Statement Template

For couples, a financial statement template is an excellent way to manage joint finances. Combining income, assets, and liabilities in one document provides transparency and prevents misunderstandings. Couples can set joint goals—like saving for a home or paying off debt—and track progress together. Using a shared financial statement template encourages communication about money, which experts agree is a key factor in maintaining healthy relationships and financial harmony.

Digital Tools That Enhance a Personal Financial Statement Template

Technology makes it easier to manage your personal financial statement template effectively. Platforms such as Tiller Money, Mint, and You Need a Budget can automate updates from your bank accounts. These apps sync with your spreadsheet, keeping your financial statement current without manual input. Combining automation with your financial statement template ensures real-time accuracy and helps you stay organized effortlessly.

Common Mistakes When Using a Personal Financial Statement Template

Even with the best personal financial statement template, mistakes can happen. Some people forget to update regularly, while others inflate asset values or underestimate debts. Inaccurate information can lead to poor decisions or unrealistic expectations. To avoid this, set calendar reminders for updates, use actual statements for accuracy, and be conservative in your estimates. The more precise your financial statement template is, the more valuable it becomes as a decision-making tool.

Personal Financial Statement Template vs. Balance Sheet

A personal financial statement template is often compared to a balance sheet, but the two serve slightly different purposes. While a balance sheet tracks a business’s assets and liabilities, a financial statement focuses on an individual’s or family’s finances. The principles are similar, but the categories differ—personal versions include expenses, income, and personal debt. This makes the financial statement template more flexible and relevant to everyday financial management.

How a Personal Financial Statement Template Supports Goal Setting

Setting achievable goals is easier when you use a financial statement template. It lets you identify your current position and what’s required to reach your next milestone. For example, if your net worth shows you’re carrying too much debt, your short-term goal might be to pay off 20% within a year. As you update your financial statement template, you can measure progress and celebrate milestones. This habit keeps you motivated and financially focused.

Maintaining Privacy When Using a Personal Financial Statement Template

Since your personal financial statement template contains sensitive financial information, security should be a top priority. If you store it online, use password-protected files and encrypted cloud services like Google Drive or Dropbox. Always keep offline backups and avoid sharing the file over unsecured emails. Protecting your data ensures your finances remain private and protected from unauthorized access.

How Often Should You Update a Personal Financial Statement Template

A personal financial statement template is most effective when kept current. Ideally, update it every quarter or whenever there’s a major financial change—like buying property, selling investments, or taking a new loan. Regular updates help you monitor changes in your financial position and maintain accuracy. It’s a small habit that can lead to big improvements in financial awareness and decision-making over time.

How a Personal Financial Statement Template Improves Financial Literacy

Using a personal financial statement template can dramatically boost your financial literacy. You’ll become more familiar with terms like assets, liabilities, and net worth, and more aware of your financial habits. As Investopedia explains, people who track their finances tend to make better long-term decisions and build wealth faster. The process of maintaining your financial statement develops discipline, accountability, and clarity—skills essential for achieving financial freedom.

Benefits of a Personal Financial Statement Template for Retirement Planning

A personal financial statement template is an indispensable tool for retirement planning. It helps you estimate how close you are to financial independence by comparing your current savings and investments with your future goals. By projecting expenses and income over time, you can adjust your savings rate and investment strategies. Using your financial statement template regularly ensures your retirement plan remains realistic and aligned with changing financial conditions.

Using a Personal Financial Statement Template for Entrepreneurship

Entrepreneurs often rely on a personal financial statement template when applying for business funding or managing both personal and business finances. Lenders review the document to assess financial stability and risk tolerance. It’s also useful for separating personal assets from business ones—a practice critical for legal protection and accurate bookkeeping. Maintaining a professional, well-organized financial statement template builds credibility and confidence with investors or partners.

FAQs About Personal Financial Statement Templates

1. What is the main purpose of a personal financial statement template? It’s used to summarize your assets, liabilities, income, and net worth for better financial management.

2. How often should I update my template? Quarterly updates keep your data accurate and reflective of your true financial position.

3. Is a personal financial statement template only for loan applications? No, it’s also a personal tool for tracking your financial health and setting goals.

4. Can I create my own template? Yes, you can build one using Excel or Google Sheets or download a ready-made version online.

5. How secure are online templates? They’re safe if you use reputable sources and store your data securely.

6. Can couples use a joint template? Absolutely—combining finances in one personal financial statement

Final Thoughts on the Power of a Personal Financial Statement Template

A personal financial statement template isn’t just a form—it’s a financial compass. It helps you navigate your current situation, plan for the future, and make smart, informed decisions. Whether you’re building wealth, applying for credit, or preparing for retirement, this tool gives you clarity and control. By using it consistently, you’ll develop stronger financial awareness and the confidence to achieve lasting stability and success.