A monthly budget planner is an essential tool for anyone who wants to take control of their finances, reduce stress, and achieve their financial goals. Managing your finances can feel overwhelming. Between bills, savings, unexpected expenses, and personal spending, it’s easy for money to slip through your fingers.

This guide will explain how to create an effective monthly budget planner, provide tips for sticking to it, and show you how to use it to improve every area of your financial life. Please read on to learn more about best budget planners to use in one of our articles.

What is a Monthly Budget Planner?

A monthly budget planner is more than a simple expense tracker. It’s a tool that allows you to:

- Visualize your finances: Understand exactly where your money goes each month.

- Plan spending proactively: Allocate money to necessary expenses, lifestyle categories, and savings goals.

- Avoid debt and late fees: Prevent overspending with clear guidelines.

- Achieve financial goals: Save for emergencies, large purchases, or investments.

Whether in a digital app, spreadsheet, or printable format, a monthly budget planner gives structure to your finances and turns abstract numbers into actionable plans.

I created a practical Monthly Budget Planner workbook for you with ready-to-use templates, worksheets, and tracking sheets.

You can download it here: Monthly Budget Planner

It includes:

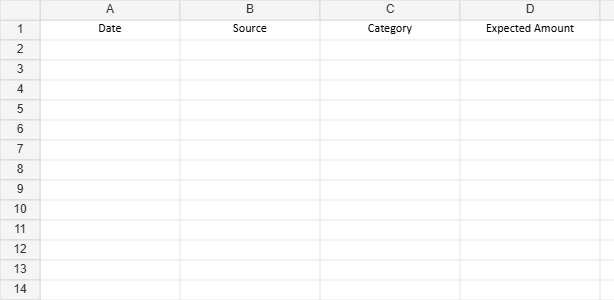

Income Tracker

Track all money coming in

Columns: Date | Source | Category | Expected | Actual | Notes

Expense Tracker

Daily spending log

Columns: Date | Expense | Category | Budgeted | Actual | Payment Method | Notes

Monthly Budget Plan (auto-calculates)

Pre-filled categories with totals + difference formulas

Shows: Planned vs Actual vs Remaining

Savings Goals Worksheet

Tracks progress toward goals

Auto-calculates remaining amount

Debt Payoff Sheet

Organize balances, rates, and payments

Dashboard (automatic summary)

Auto-calculates:

• Total Income

• Total Expenses

• Net Savings

Why You Need a Monthly Budget Planner

Budgeting isn’t about restricting yourself—it’s about gaining control. Using a monthly planner helps you:

- Reduce financial stress: Knowing where your money goes reduces anxiety.

- Avoid overspending: Tracking expenses prevents surprises.

- Increase savings: Allocate funds intentionally for short-term goals, emergencies, and long-term dreams.

- Plan for big expenses: Holidays, birthdays, or home repairs are easier to manage with a plan.

- Improve financial decisions: When you see your finances clearly, you make better choices.

Expert Reference: According to Investopedia, consistent budgeting is key to building wealth and financial security.

Step-by-Step Guide to Setting Up Your Monthly Budget Planner

Calculate Your Income

Start with all sources of income, including:

- Salary/wages

- Side hustles or freelance work

- Passive income (investments, rental income)

This total income will form the foundation of your monthly planner. Use your net income (after taxes) for the most accurate budgeting.

List Your Expenses

Divide expenses into categories:

Fixed Expenses: Rent, mortgage, utilities, subscriptions

Variable Expenses: Groceries, dining out, transportation

Lifestyle & Fun: Hobbies, personal care, entertainment

Savings & Investments: Emergency fund, retirement, college fund

Be honest about all spending. Include small items like coffee or snacks—these add up.

Track Every Dollar

Record all spending throughout the month. Options include:

- Digital apps: Mint, YNAB, GoodBudget

- Spreadsheet templates: Google Sheets or Excel

- Printable sheets: Pinterest or template sites

Tracking every dollar helps identify spending leaks and optimize allocation.

Set Monthly Goals

Decide how much to allocate for savings, debt repayment, and lifestyle. Example goals:

- Saving $200 for emergencies

- Paying off $150 of credit card debt

- Allocating $100 for fun activities

Review and Adjust

Check your planner weekly or monthly. Identify overspending trends, adjust allocations, and celebrate progress.

How to Stick to Your Monthly Budget

- Automate savings: Set up recurring transfers to savings accounts.

- Use cash envelopes: Great for categories like dining or entertainment.

- Track spending daily: Avoid surprises and impulse purchases.

- Review monthly: Adjust categories and spending based on real data.

- Reward yourself: Small rewards keep motivation high.

Best Tools for Monthly Budget Planning

1. Digital Apps:

- YNAB (You Need a Budget): Encourages proactive planning and goal-setting.

- Mint: Free, connects directly to bank accounts, and categorizes expenses automatically.

- GoodBudget: Uses the envelope budgeting method for intuitive planning.

2. Spreadsheets:

- Excel or Google Sheets offer flexibility to customize your monthly planner.

3. Printable Planners:

- For those who prefer pen-and-paper, downloadable budget sheets from sites like Pinterest or Template.net are popular.

Real-Life Case Studies: Monthly Budget Planner in Action

Case Study 1: Freelance Graphic Designer

Jane earns an irregular income. By tracking her monthly earnings and prioritizing essential expenses, she created a “variable income budget.” She allocated any extra income toward travel and savings while staying debt-free.

Case Study 2: Young Family

The Martins, a family of four, struggled with overspending on groceries and dining out. By implementing a budget planner, they identified spending leaks and saved $400/month toward their first family vacation.

Case Study 3: College Student

Alex used a digital budget planner to track loans, tuition, and daily expenses. By automating savings for textbooks and emergency costs, Alex avoided high-interest credit card debt.

Advanced Tips for Optimizing Your Monthly Budget Planner

- Track irregular expenses: Account for yearly or quarterly costs.

- Set “fun money”: Avoid feeling restricted while staying on budget.

- Use goal-based categories: Emergency fund, travel, education.

- Review subscriptions: Cancel unused services to free up cash.

- Combine budgeting with personal finance apps for real-time insights.

Common Mistakes to Avoid

- Underestimating variable expenses

- Not tracking small purchases

- Setting unrealistic goals

- Ignoring debt payments

- Not reviewing your budget regularly

Monthly Budget Planner Templates

- Simple Budget Sheet: Columns for income, fixed expenses, variable expenses, and savings.

- Detailed Planner: Includes debt tracker, bill calendar, and spending notes.

- Digital Planner Layout: Dashboards with charts showing spending by category, monthly savings progress, and goal completion.

Linking Monthly Budget Planner With Other Financial Tools

- Savings Apps: Acorns, Qapital

- Debt Management Apps: Undebt.it, Tally

- Investment Platforms: Betterment, Vanguard

Integrating your monthly planner with other financial tools gives a complete picture of your money.

FAQs About Monthly Budget Planners

Q1: How often should I update my monthly budget planner?

Update weekly to track spending accurately and make adjustments.

Q2: Can a monthly budget planner work for irregular income?

Yes, prioritize essential expenses and allocate a portion of each paycheck toward variable expenses and savings.

Q3: Should I include debt payments in my budget?

Yes, all loans, credit cards, and other liabilities should be tracked.

Q4: Can I use a digital and printable planner at the same time?

Absolutely. Many people use digital for tracking and printable sheets for quick reference.

Q5: How do I choose the right planner?

Consider your lifestyle, comfort with technology, and level of detail you want to track.

Benefits of a Monthly Budget Planner

- Increased awareness of spending habits

- Reduced risk of debt accumulation

- Better planning for large purchases or emergencies

- Enhanced control over personal finances

- Clear path to achieving financial goals

Conclusion

A monthly budget planner is more than a list of numbers—it’s a roadmap for your financial life. It helps you:

- Gain clarity and confidence in managing money

- Achieve short-term and long-term financial goals

- Reduce stress and improve spending habits

- Build a lifestyle that aligns with your values

Whether you prefer digital, printable, or spreadsheet formats, starting and maintaining a monthly budget planner is the most effective step toward financial freedom.