If you’re considering financing options to make purchases easier and more affordable, the Room to Go credit card can be a helpful tool to use. By understanding how the card works, comparing financing options, and aligning purchases with your budget. You can make the most of your credit without unnecessary stress. Whether you’re upgrading furniture, creating a cozy living space, or planning a full home makeover, the Room to Go credit card can be a part of a thoughtful and financially sound plan.

Furnishing a home can be exciting, but it can also be expensive. Whether you’re moving into a new apartment, upgrading your living room. When replacing worn-out furniture, the costs can add up quickly. This is why many shoppers look for financing options. That allow them to spread payments over time instead of paying everything upfront. One option that often comes up is the Room to Go credit card.

Room to Go is a popular furniture retailer known for sofas, bedroom sets, dining furniture, mattresses, and home décor. The Room to Go credit card is designed to help customers afford larger purchases through special financing offers. In this detailed guide, we’ll walk through how the Room to Go credit card works. The benefits, potential drawbacks, how to apply, and how to use it wisely. As it supports your finances rather than stressing them. Please read on to learn more about home decor financing in one of our pages

What Is the Room to Go Credit Card?

The Room to Go credit card is a store credit card created specifically for purchases made at Room to Go stores. And on the official RoomToGo.com website. It is usually issued by a financing partner such as Synchrony Bank. Unlike regular credit cards that can be used anywhere, this card is limited to Room to Go purchases only.

The card gives approved customers a line of credit. That can be used to buy furniture, mattresses, décor, and related items. Many people choose this card because Room to Go often offers promotional financing, making it easier to afford higher-priced items. Like sectional sofas, full bedroom sets, or complete living room packages.

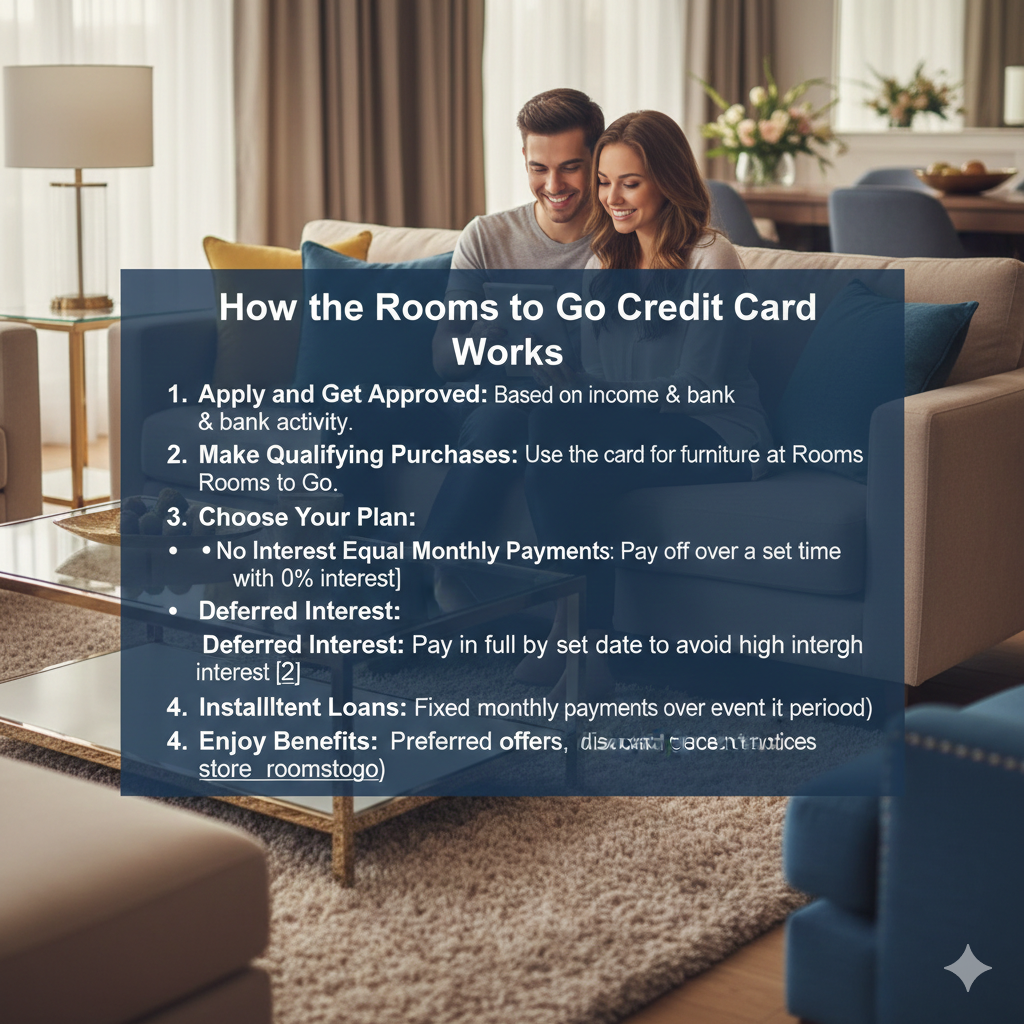

How the Credit Card Works

Once approved, you receive a credit limit that you can use for eligible purchases at Room to Go. You can apply for the card either in a physical store or online during checkout. Approval decisions are often instant, allowing you to use the card right away.

The most attractive feature of the Room to Go credit card is promotional financing. These offers commonly include “no interest if paid in full” plans for a set period. Such as 6, 12, 18, or sometimes 24 months. This means you can divide your purchase into monthly payments without paying interest. As long as you pay the full balance before the promotional period ends.

It’s important to understand that most of these offers use deferred interest. If the balance is not fully paid by the end of the promotional period, interest may be added retroactively from the date of purchase. This makes planning and on-time payments extremely important.

Common Financing Offers You May See

Room to Go financing offers can change throughout the year, but typical promotions include no interest if paid in full within a certain number of months on purchases above a minimum amount. Some promotions may also include fixed monthly payments with reduced interest rates.

These offers are especially helpful for customers buying large furniture items that would otherwise require a large upfront payment. However, promotional terms should always be reviewed carefully before agreeing to them.

Benefits of the Room to Go Credit Card

One major benefit of the Room to Go credit card is affordability. Financing allows customers to purchase quality furniture without draining their savings all at once. This can be especially helpful for families, first-time homeowners, or anyone furnishing multiple rooms.

Another advantage is convenience. The card is directly linked to Room to Go, making the checkout and financing process simple. Many customers also appreciate access to special promotions that may not be available with other payment methods.

For those trying to build or improve their credit, responsible use of the card can help. Making on-time payments and keeping balances manageable can contribute positively to your credit history over time.

Potential Drawbacks to Keep in Mind

Despite its benefits, the Room to Go credit card is not perfect for everyone. One drawback is the interest rate. Like many store credit cards, the regular interest rate can be relatively high if you carry a balance outside of promotional offers.

Another limitation is flexibility. Because the card can only be used at Room to Go, it does not offer the versatility of general credit cards that can be used for everyday purchases or emergencies.

There is also the risk of overspending. Financing can make expensive items feel more affordable in the moment, which may lead some people to buy more than they can comfortably repay. Without a clear repayment plan, this can cause financial strain.

How to Apply for Credit Card

Applying for the Room to Go credit card is straightforward. You can apply online through the Room to Go website or in-store with assistance from a sales associate. The application typically asks for basic personal and financial information, including income and identification details.

Approval depends on factors such as your credit score, income level, and overall credit history. If approved, you’ll receive details about your credit limit, promotional financing offers, and payment terms. Always review these details carefully before making a purchase.

Smart Tips for Using the Room to Go Credit Card

To use the Room to Go credit card wisely, it’s best to plan purchases ahead of time. Only finance items you truly need and can afford to repay within the promotional period. Setting reminders for payment due dates can help avoid late fees and missed payments.

Creating a simple payment plan before using promotional financing is also helpful. Divide the total balance by the number of months in the promotional period and aim to pay that amount consistently. This reduces the risk of interest being added later.

Avoid using the full credit limit if possible. Keeping balances lower can help protect your credit score and make payments more manageable.

Comparing Room to Go Financing With Other Options

Before choosing the Room to Go credit card, it can be useful to compare it with other financing options. Some general credit cards offer 0% introductory APR on purchases for a limited time. Which may provide similar benefits with more flexibility.

Personal loans are another option, especially for larger furniture purchases. They usually come with fixed monthly payments and predictable interest, though approval requirements may be stricter.

In some cases, saving up and paying cash may be the most financially comfortable choice. Comparing all options ensures you choose the one that best fits your situation. You can read more about Rooms To Go financing options.

Real-Life Examples of How People Use the Card

Many customers use the Room to Go credit card when furnishing a new home. For example, someone moving into a new apartment may finance a sofa, bed, and dining set together and pay it off over a year using promotional financing.

Others use the card to replace worn furniture gradually, such as upgrading a mattress first and adding additional pieces later. In these situations, financing helps spread costs without disrupting monthly budgets.

Frequently Asked Questions

Is the Room to Go credit card easy to get approved for? Approval depends on your credit profile, but store cards are often more accessible than traditional credit cards.

Can I use the card outside Room to Go? No, it is limited to Room to Go purchases only.

Does the card have an annual fee? Most Room to Go credit cards do not charge an annual fee, but always confirm current terms.

What happens if I miss a payment? Missing a payment may result in late fees and could impact your credit score.

Final Thoughts

The Room to Go credit card can be a useful tool for furnishing your home when used carefully and responsibly. Its financing options can make large purchases more manageable, especially during promotional periods. However, understanding the terms, planning payments, and avoiding unnecessary debt are key to making it work in your favor.