This article explores practical suggestions for saving money, from daily habits and budget strategies to tools, apps, and real-life tips. The truth is, saving money isn’t about extreme sacrifices or giving up the things you enjoy—it’s about making smart, intentional choices, creating better habits, and finding strategies that work for your lifestyle. By implementing simple methods consistently, anyone can grow their savings, reduce financial stress, and work toward both short-term and long-term financial goals.

Saving money can feel like a challenge in today’s fast-paced world. With bills to pay, unexpected expenses, and temptations everywhere, it’s easy to feel like saving is impossible. Whether you’re a beginner trying to build your first emergency fund or an experienced saver looking to optimize your strategy, you’ll find actionable ideas that make saving easier and more sustainable.

Why Saving Money Is Important

Saving money is more than just putting aside cash; it’s about financial security and freedom. A solid savings plan helps you handle unexpected expenses, avoid debt, and reach goals like buying a home, starting a business, or traveling. According to Investopedia, financial stability starts with consistent saving habits rather than relying on sporadic windfalls or last-minute budgeting.

Beyond security, saving money provides peace of mind. Knowing that you have a cushion to fall back on reduces anxiety and helps you make decisions confidently, whether it’s pursuing new opportunities, handling emergencies, or planning for retirement.

Practical Suggestions for Saving Money

There are countless ways to save money, but not all strategies work for everyone. Here are some of the most effective, beginner-friendly suggestions:

1. Track Your Spending

Before you can save effectively, you need to know where your money goes. Use apps like Mint, YNAB (You Need a Budget), or simple spreadsheets to track your income and expenses. Monitoring your spending helps you identify areas where you can cut back and redirect funds toward savings.

2. Create a Realistic Budget

A budget isn’t about restriction—it’s about planning. Allocate funds for essentials like rent, bills, groceries, and transportation, then assign a portion to savings. Treat your savings like a non-negotiable expense rather than leftover money at the end of the month.

3. Automate Your Savings

Set up automatic transfers to a separate savings account. Even small amounts like $20 a week add up over time. Automation removes the temptation to spend and ensures that saving is consistent.

4. Cut Unnecessary Expenses

Review your subscriptions, memberships, and recurring expenses. Cancel or downgrade services you rarely use. Small cuts like these can free up significant amounts of money over time.

5. Use Cashback and Rewards Programs

Take advantage of credit card rewards, cashback apps, and loyalty programs for purchases you were already planning to make. These small incentives can add up without changing your lifestyle.

Practical Suggestions for Saving Money 2

1. Practice Mindful Spending

Before making a purchase, ask yourself: “Do I really need this?” Delaying non-essential purchases by 24–48 hours can reduce impulse spending and help you prioritize your savings goals.

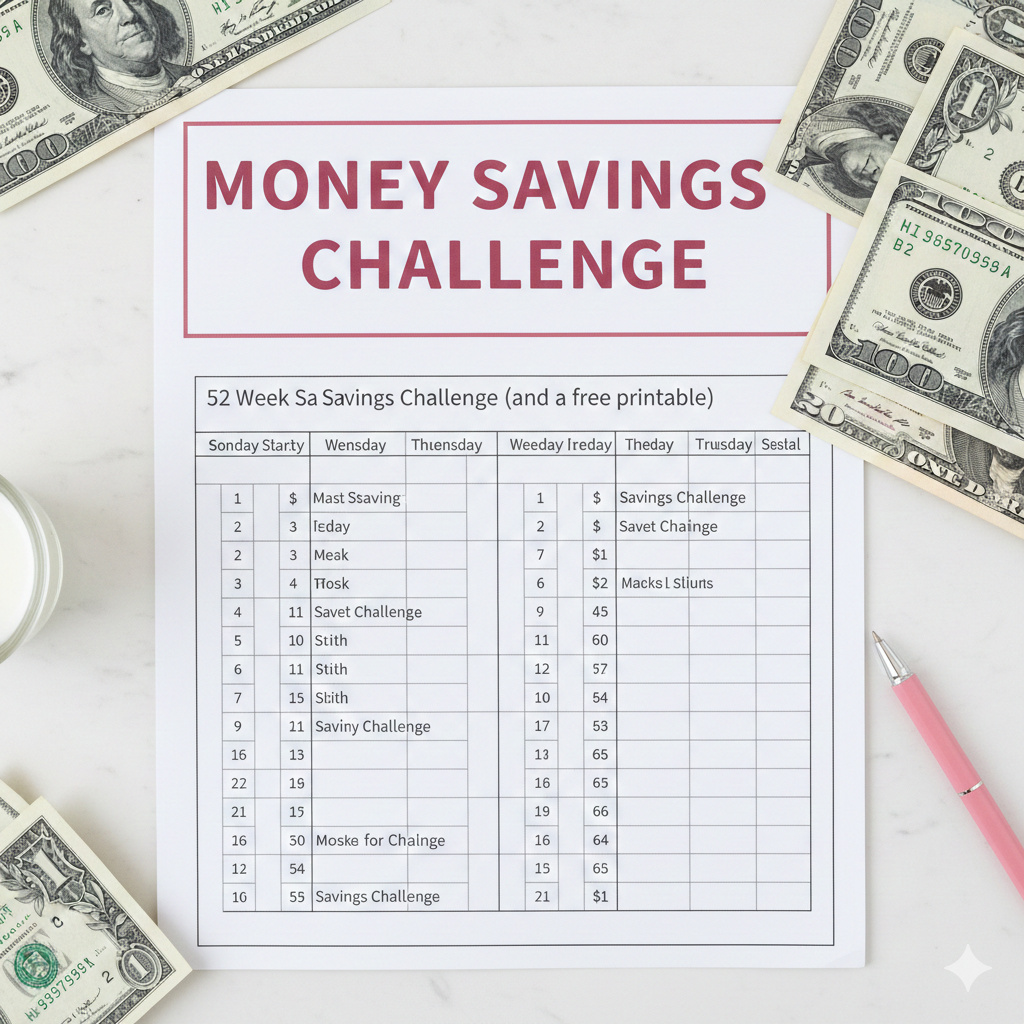

2. Implement a Savings Challenge

Challenges like the 52-week savings challenge, no-spend weeks, or micro-saving goals can turn saving into a structured habit. Gamifying the process makes it fun and motivating. Learn more about savings challenges here:

3. Reduce Utility Bills

Simple changes like turning off lights, using energy-efficient appliances, and adjusting your thermostat can reduce monthly utility costs. Small adjustments consistently can free up extra cash for savings.

4. Cook at Home More Often

Eating out frequently adds up quickly. Preparing meals at home not only saves money but can also improve health and reduce food waste. Batch cooking and meal prepping are especially effective.

2. Avoid High-Interest Debt

Credit card debt can quickly erode your ability to save. Focus on paying down high-interest debt first, and avoid carrying balances that accrue interest. Once debts are under control, redirect those payments toward savings.

Advanced Suggestions for Maximum Savings

For those ready to take their savings further, consider these strategies:

1. Negotiate Bills and Subscriptions

Call your service providers and ask for discounts on insurance, internet, or phone plans. Many companies are willing to reduce rates for loyal customers or match competitor prices.

2. Shop Smart

Use price comparison tools, coupons, and seasonal sales. Buying in bulk for non-perishable items can also reduce costs over time.

3. Use a Cash Envelope System

Divide cash into envelopes for categories like groceries, entertainment, and transport. Spending is limited to what’s in each envelope, which helps you stick to your budget and increase savings.

4. Invest Your Savings

Once you have an emergency fund, consider putting extra savings into low-risk investments or retirement accounts. Money in savings accounts grows slowly, but investing allows your funds to work for you over time.

5. Combine Income Streams

Freelancing, side hustles, or part-time work can accelerate your savings goals. Even small extra income streams contribute significantly when consistently allocated toward savings.

Tools, Apps, and Templates for Saving Money

- Mint: Tracks spending, budgets, and savings automatically.

- YNAB (You Need a Budget): Helps allocate funds efficiently and track savings goals.

- Acorns: Rounds up everyday purchases and invests the spare change.

- Vertex42 Templates: Free spreadsheets for budgeting and savings tracking.

- Qapital App: Helps automate savings challenges using customizable rules.

Real-Life Money-Saving Examples

- Sarah, a young professional, saved $1,200 in a year by implementing a 52-week savings challenge while cutting small daily expenses like coffee and snacks.

- A family of four reduced monthly spending on entertainment and groceries using a cash envelope system, redirecting $300 per month to their vacation fund.

- Mark, a freelancer, automated 15% of his income into a savings account and tracked all spending using Mint, allowing him to reach his emergency fund goal within eight months.

Common Mistakes People Make While Saving

- Skipping Tracking: Without visibility, it’s easy to overspend.

- Unrealistic Goals: Setting unattainable targets leads to frustration and quitting.

- Mixing Savings and Spending Accounts: This makes it easy to spend what should be saved.

- Ignoring Small Wins: Even minor savings matter over time; celebrate milestones to stay motivated.

Frequently Asked Questions (FAQ)

Q: Can I start saving even if I have debt?

Yes. Focus on high-interest debt first, but even small savings provide a safety net and build good habits.

Q: How much should I save each month?

A good rule of thumb is 20% of your income, but any consistent amount works as long as it’s sustainable.

Q: Are savings challenges only for beginners?

No. Challenges can help both beginners and experienced savers stay motivated and reach specific goals.

Q: Do I need a special account for savings?

A separate account is helpful to avoid accidental spending and to track growth clearly.

Q: How do I stay motivated to save long-term?

Visual trackers, milestones, accountability partners, and gamified challenges help maintain motivation over time.

Money savings Challenges

Saving money can feel like a struggle, especially when expenses keep piling up. But what if saving could be fun, creative, and even a little competitive? That’s where money saving challenges come in. These challenges turn saving into a game, making it easier to build consistent habits and reach your financial goals. You can read on to learn more about money saving challenges in one of our pages

Why Try Money Saving Challenges?

Money saving challenges work because they give your savings a clear structure. Instead of randomly putting aside money, you follow a plan, track your progress, and see results grow over time. Challenges also help you identify unnecessary spending and encourage mindful financial decisions.

Popular Money Saving Challenges

1. 52-Week Savings Challenge

Start small and increase your savings weekly. Save $1 in week 1, $2 in week 2, up to $52 in week 52. By the end of the year, you could save over $1,300 without feeling a heavy burden.

2. No-Spend Challenge

Pick a day, weekend, or week to spend only on essentials. No eating out, online shopping, or unnecessary splurges. The money you save during this period can go straight into your savings.

3. Round-Up Challenge

Every time you make a purchase, round up to the nearest dollar and save the extra. Spending $4.75? Save $0.25. These small amounts add up faster than you think.

4. Cash Envelope Challenge

Use envelopes for categories like groceries, transport, and entertainment. Once the cash is gone, stop spending in that category. This method keeps you accountable and encourages savings.

5. Change Jar Challenge

Collect all your spare change in a jar. At the end of the month, deposit it into your savings account. It’s simple, easy, and surprisingly effective.

Tips for Success

- Set clear goals: Know what you’re saving for and how much.

- Track progress: Use a notebook, app, or spreadsheet.

- Be consistent: Even small amounts make a difference over time.

- Make it fun: Turn challenges into games with friends or family.

Money saving challenges aren’t just about the money — they teach discipline, awareness, and smart financial habits. Start with one challenge that fits your lifestyle, and you’ll be amazed at how quickly your savings can grow.

- Final Thoughts

Saving money doesn’t have to be difficult or stressful. By following Practical Suggestions for Saving Money, using tools effectively, and building consistent habits, anyone can achieve their financial goals. Start small, stay consistent, and remember that saving is about progress, not perfection. Whether you implement a daily micro-saving habit, a monthly challenge, or more advanced budgeting strategies, the key is to take action today. Small steps accumulate, and over time, they lead to financial security, reduced stress, and the freedom to live life on your terms.