The integration of blockchain technology into the banking sector marks a transformative era for financial services, offering unprecedented levels of transparency, security, and efficiency. As we delve into the recent developments in blockchain within banking, we uncover how this technology is not only revolutionizing peer-to-peer payments and remittances but also redefining trading, trade finance, and regulatory compliance. This article explores the multifaceted impact of blockchain on the financial landscape and anticipates the future of banking in a world increasingly embracing digital currencies and decentralized financial models.

Key Takeaways

- Blockchain technology is streamlining banking operations, significantly reducing bureaucracy and increasing efficiency in clearing and settlement processes.

- Financial institutions are increasingly adopting digital currencies, driven by the advantages of blockchain such as lower transaction costs and faster transaction speeds.

- In trade finance, blockchain is enhancing transaction security, reducing counterparty risks, and bringing transparency to supply chains.

- Blockchain is addressing fintech challenges by decentralizing operations, cutting operational costs, and improving trust and regulatory compliance.

- The future of financial services with blockchain points towards transformative financial models, including crypto lending, blockchain-based crowdfunding, and digital identity verification systems.

Revolutionizing Banking with Blockchain

Enhancing P2P Payments and Remittances

The advent of blockchain technology has significantly improved the efficiency of peer-to-peer (P2P) payments and remittances. Blockchain reduces the need for intermediaries, which traditionally contribute to high fees and slow transaction times. For instance, companies like BitPesa are targeting regions such as Africa to slash remittance fees from an average of 11% to just 3%.

Blockchain’s ability to synchronize payment and messaging between banks is revolutionizing the remittance industry, which is particularly impactful in regions with traditionally high transfer costs.

The traditional SWIFT system, while reliable for messaging, often results in transactions passing through multiple banks, accumulating fees and delays. In contrast, cryptocurrencies like XRP are addressing these inefficiencies by facilitating more direct and cost-effective transactions.

- **Key Benefits of Blockchain in P2P Payments and Remittances: **

- Reduced transaction fees

- Faster transfer times

- Decreased reliance on multiple financial institutions

The potential of blockchain in this domain is underscored by the significant market size of remittances, which is a $400 billion industry. As blockchain continues to mature, it is expected to unlock even greater efficiencies and cost savings in the remittance sector.

Streamlining Clearing and Settlement Processes

The integration of blockchain technology into clearing and settlement processes is poised to revolutionize the banking sector. Accenture estimates significant cost savings, potentially up to $10 billion for major investment banks, by adopting blockchain systems. The Australian Securities Exchange’s initiative to move its post-trade services onto a blockchain platform exemplifies this shift towards more efficient infrastructures.

Blockchain’s ability to provide real-time fund transfers with minimal fees is a game-changer, especially when compared to traditional systems like SWIFT, which are often slow and incur costs at each step. By eliminating the need for third-party facilitators, blockchain ensures a smoother and more direct flow of transactions.

The projected cost savings and efficiency gains from blockchain adoption in banking highlight the transformative potential of this technology. It not only streamlines operations but also reduces the reliance on human labor and outdated systems.

The current trade finance system, burdened with paperwork and a multi-step verification process, stands to benefit immensely from blockchain. By cutting down the settlement time from days to mere minutes, blockchain can address the inefficiencies of the existing brokerage and exchange mechanisms.

Adoption of Digital Currencies by Financial Institutions

The financial landscape is witnessing a paradigm shift with the adoption of digital currencies by banks and other financial institutions. These digital assets offer a plethora of advantages, including lower transaction costs and faster processing times, which are driving the global financial community to consider integrating blockchain-based currencies into their operations.

- Lower transaction costs

- Faster transaction processing

- Enhanced security

- Potential for financial inclusion

Despite the clear benefits, the journey towards widespread adoption is fraught with legislative and technological challenges. The evolution of digital currencies is still in its infancy, and as such, it is subject to ongoing debates and research. Financial institutions must navigate complex regulatory frameworks, like the guidelines issued by FinCEN, which mandate compliance with traditional money transmission rules for entities dealing with digital currencies.

The transformative potential of digital currencies extends beyond mere efficiency gains. It promises to redefine the very fabric of financial services, making it crucial for institutions to stay abreast of developments and tread carefully in this new digital frontier.

Blockchain’s Role in Trading and Trade Finance

Facilitating Faster and More Secure Transactions

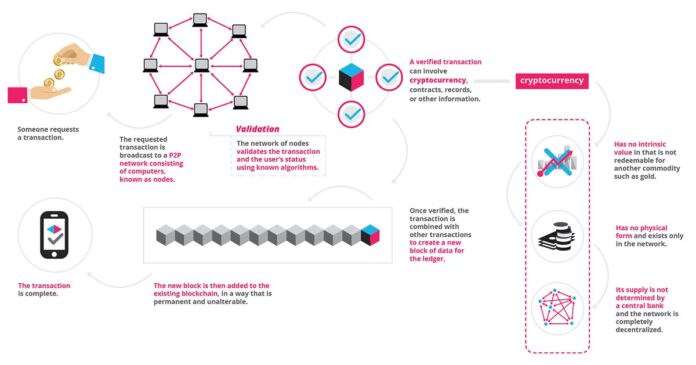

The integration of blockchain technology in financial transactions has marked a significant shift towards speed and security. By leveraging a decentralized network, blockchain ensures that transaction records are not only immutable but also transparent, making it difficult for fraudulent activities to occur. This robustness is due to the fact that altering any information would require the consensus of the majority of nodes in the network, a feat that is practically unattainable for malicious actors.

- Decentralization: Multiple nodes maintain transaction records, enhancing security.

- Immutability: Once recorded, transactions cannot be altered without network consensus.

- Transparency: All participants can view transaction histories, fostering trust.

Blockchain’s inherent features significantly reduce the risk of fraud and data duplication, while simultaneously maintaining a comprehensive audit trail. These advancements are not only beneficial for the security of bank transactions but also for the overall integrity of the financial system.

Financial institutions are increasingly recognizing the potential of blockchain to streamline operations and cut costs. The technology’s ability to automate processes through smart contracts and reduce the need for intermediaries can lead to more efficient and less error-prone systems. As a result, the adoption of blockchain is poised to transform the banking industry, offering a glimpse into the future of blockchain in banking.

Reducing Counterparty Risks and Improving Transparency

The advent of blockchain technology in the financial sector has brought about a significant reduction in counterparty risks and a leap in transparency. Blockchain’s immutable ledger ensures that all transactions are recorded and verifiable, making it difficult for fraudulent activities to go unnoticed. This transparency is not just beneficial for regulatory compliance but also for fostering trust among trade participants.

One of the key areas where blockchain has made an impact is in the realm of supply chain finance. The technology provides a transparent and secure environment for all parties involved, from producers to consumers. Here’s how blockchain contributes to reducing risks and improving transparency:

- Supply Chain Transparency: Blockchain’s publicly accessible ledgers offer complete visibility into supply chain activities, automating control and eliminating the need for centralized oversight.

- Tokenization: By tokenizing assets, blockchain provides a robust solution to the risks associated with new financial markets, such as GreenFi.

- Optimized Trade Lifecycle: Blockchain streamlines the entire trade process, from reducing the need for burdensome counterparty checks to speeding up settlements and improving trade accuracy.

The integration of blockchain technology in financial services has revolutionized the way we approach risk management, security, and transparency in trade and finance systems.

With blockchain, the financial industry is witnessing a paradigm shift where security protocols, mutualized standards, and shared processes are not only enhancing data integrity but also improving the customer experience with faster processing. The selective sharing of data, supported by blockchain’s privacy tools, ensures that confidentiality is maintained without compromising on transparency.

Innovations in Supply Chain Finance

Blockchain technology is poised to revolutionize supply chain finance, offering unprecedented transparency and security. By leveraging distributed ledgers, businesses can gain real-time insights into their supply chains, ensuring that every transaction is recorded and verifiable. This level of clarity is particularly beneficial for sustainable finance, where ethical sourcing and environmental impact are increasingly scrutinized.

Blockchain’s ability to automate supply chain control reduces the need for centralized oversight, streamlining operations and potentially lowering costs.

The table below outlines the key benefits of integrating blockchain into supply chain finance:

| Benefit | Description |

|---|---|

| Transparency | Public ledgers provide clear visibility into transactions. |

| Security | Enhanced protection against fraud and unauthorized activities. |

| Efficiency | Automation and smart contracts speed up processes. |

| Trust | Immutable records improve trust among stakeholders. |

As the technology matures, its applications in finance continue to expand, offering a range of advantages from digital security issuance to cost-effective business networks. The adoption of blockchain in trade finance, a sector that underpins a significant portion of global commerce, is a testament to its transformative potential.

Overcoming Fintech Challenges through Blockchain

Addressing Centralization and Trust Issues

The integration of blockchain technology in financial services is addressing the inherent dependency on centralized systems that has long been a challenge in fintech. With blockchain, the power dynamics shift as transactions no longer rely solely on the approval of higher authorities, providing users with a more autonomous and efficient experience.

Blockchain’s decentralized nature establishes algorithmic trust, which is crucial in a sector where trustability is paramount. This shift from centralized control to a distributed network of nodes not only enhances security but also democratizes financial operations, allowing for a more inclusive financial ecosystem.

The transformative potential of blockchain extends beyond transactions, offering a robust framework for protecting resources and information from the control of any single entity.

As the technology matures, legal challenges remain a significant hurdle. However, the promise of blockchain to disrupt traditional financial models and empower users continues to drive its adoption and innovation within the sector.

Cutting Operational Costs and Enhancing Efficiency

Blockchain technology is poised to transform the banking sector by significantly reducing operational costs and enhancing process efficiency. By automating and streamlining financial operations, blockchain reduces the reliance on manual labor and expedites transactions, leading to substantial cost savings for banks.

The integration of blockchain into banking operations not only boosts the efficiency of their operations but also improves the accuracy of investment decisions. This dual benefit is a key driver for financial institutions looking to stay competitive in a rapidly evolving market.

The projected cost savings from blockchain adoption in banking underscore its potential to drive financial institutions towards a more cost-effective and sustainable future.

According to industry forecasts, by 2030, technologies like blockchain, AI, and robotics could enable banks to slash operational costs by 20% to 25%. This equates to an estimated total saving of $1 trillion, highlighting the transformative impact of these technologies on the financial sector.

Improving Regulatory Compliance and Audit Trails

The integration of blockchain technology into financial services is transforming the landscape of regulatory compliance and audit trails. Blockchain’s inherent transparency and immutability offer a robust framework for tracking and verifying transactions, ensuring that each action taken by associated parties is recorded and easily auditable by regulators. This not only streamlines the compliance process but also significantly reduces the risk of financial fraud.

Financial institutions are increasingly leveraging blockchain to meet stringent regulatory requirements. In the EU and globally, regulations are intensifying, particularly around sustainability targets. Blockchain projects that align with these regulations by design offer businesses a competitive edge, minimizing the risk of non-compliance penalties.

The adoption of blockchain in regulatory compliance is not just about adhering to current standards but also about setting a new benchmark for transparency and accountability in financial reporting.

The table below outlines key areas where blockchain is enhancing regulatory compliance in the financial sector:

| Area | Impact |

|---|---|

| Transaction Tracking | Simplified verification process |

| Document Authenticity | Access to original documents |

| KYC/AML Checks | Reduction in fraudulent accounts |

| Sustainability Targets | Compliance with environmental regulations |

As the demand for regulatory services grows, fintech companies are poised to continue this trend, with blockchain at the forefront of innovation in compliance and reporting.

The Emergence of New Financial Models via Blockchain

Crypto Lending Platforms

Crypto lending platforms are transforming the way loans are facilitated in the financial sector. Borrowers can leverage their crypto assets as collateral to secure loans in fiat currency or stablecoins, while lenders provide the necessary funds at an agreed interest rate. Conversely, borrowers may also use fiat or stablecoins as collateral to obtain crypto assets.

The process is marked by its efficiency and transparency, distinguishing it from traditional lending mechanisms. It offers a glimpse into the potential for a more open financial system, one that could challenge or even disrupt traditional shadow banking practices.

The rise of crypto lending platforms signals a shift towards more accessible and flexible financial services, where the terms are clear and the transactions are swift.

While these platforms present new opportunities, they also necessitate careful consideration of regulatory compliance to ensure the security and legitimacy of transactions.

Blockchain-based Crowdfunding

Blockchain technology is reshaping the crowdfunding landscape by introducing new models that enhance transparency and speed. Initial Coin Offerings (ICOs), for instance, have emerged as a popular alternative to traditional venture capital, often providing a more democratic way for startups to raise capital. The decentralized nature of blockchain allows for a direct connection between investors and entrepreneurs, reducing the need for intermediaries.

The transformative impact of blockchain on lending practices extends to crowdfunding, where it enables a more inclusive and efficient fundraising ecosystem.

Here are some key advantages of blockchain-based crowdfunding:

- Increased transparency: Every transaction is recorded on a public ledger, ensuring that fund usage is visible to all stakeholders.

- Global participation: Blockchain removes geographical barriers, allowing anyone with internet access to invest.

- Automated compliance: Smart contracts can automate the enforcement of regulatory requirements, simplifying the compliance process.

- Enhanced security: The immutable nature of blockchain records helps protect against fraud and misuse of funds.

Digital Identity Verification Systems

The integration of blockchain technology into digital identity verification systems is transforming the security landscape of financial services. Blockchain’s immutable ledger ensures that once an identity is verified, it cannot be altered or tampered with, providing a robust defense against identity theft and fraud. This technology enables a more streamlined and secure process for identity management, which is critical in an era where digital interactions are predominant.

Financial institutions are beginning to recognize the benefits of blockchain-based identity systems. These systems allow for:

- Secure management of identity data

- Safe sharing of data across platforms without compromising security

- Digital signing of documents, enhancing the integrity of transactions

By leveraging blockchain, financial services can offer their clients a single, secure digital identity that can be used globally, simplifying the customer experience while maintaining high security standards. The potential for blockchain in this domain is vast, with possibilities extending to areas such as voting systems and educational credential verification.

The Future of Blockchain in Financial Services

Predictions Based on Current Trends and Research

As the financial industry continues to evolve, blockchain technology stands at the forefront of this transformation, promising to redefine the landscape of financial services. Existing research underscores the potential of blockchain to enhance corporate decision-making processes, emphasizing improvements in openness, accountability, and efficiency.

The integration of blockchain into financial services is not just a trend; it’s a paradigm shift that is gradually becoming a fundamental aspect of modern finance.

The following points encapsulate the essence of blockchain’s trajectory in the financial sector:

- The continuous growth of decentralized finance (DeFi) platforms.

- Increasing adoption of blockchain for cross-border payments and remittances.

- Expansion of blockchain applications beyond cryptocurrencies, into areas such as identity verification and fraud prevention.

- Greater emphasis on regulatory compliance and the development of legal frameworks to support blockchain integration.

These developments suggest a future where blockchain is deeply embedded in the fabric of financial services, driving innovation and efficiency across various domains.

Potential Disruptions and Industry Transformations

The integration of blockchain technology into financial services is poised to usher in a new era of disruption and transformation. As the fintech industry harnesses blockchain’s potential, we can expect a shift in how traditional banking and financial operations are conducted.

- Decentralization of financial systems: Blockchain’s inherent characteristic of decentralization could lead to more democratic financial systems where power is distributed among users rather than centralized in a few institutions.

- Tokenization of assets: The conversion of physical and intangible assets into digital tokens could revolutionize asset management and investment strategies.

- Smart contracts: These self-executing contracts with the terms directly written into code could automate and streamline complex financial transactions.

The transformative impact of blockchain extends beyond mere efficiency gains; it promises to redefine the very fabric of the financial industry.

The landscape of financial services is rapidly evolving, with blockchain at the forefront of this change. The implications for revenue generation, user experience, and operational efficiency are significant, marking a pivotal moment in the history of finance.

Regulatory Developments and Their Implications

The regulatory landscape for blockchain in financial services is evolving as authorities seek to balance innovation with risk management. The governance and risk management practices are crucial for maintaining the integrity of the financial system, especially as crypto assets increasingly interact with macroeconomic and financial stability. Regulatory bodies are adapting to the technology’s ability to provide transparent and immutable records, which enhances compliance and audit capabilities.

With the rise of blockchain, regulatory agencies have underscored the relevance of existing laws to new technologies. For instance, the Federal Reserve’s technology-neutral stance ensures that compliance with laws like the Community Reinvestment Act remains intact, regardless of the technology employed. This approach is reflected in the recent Executive Order No. 14110, which emphasizes the applicability of regulations to banking organizations using blockchain.

The integration of blockchain into regulatory frameworks is enabling fintech companies to streamline compliance processes. By leveraging distributed ledger technology, firms can provide regulators with direct access to original documents, reducing the need for multiple copies and enhancing the efficiency of regulatory reviews.

As the regulatory environment continues to adapt, financial institutions must stay informed of the latest developments to ensure they remain compliant. The table below summarizes key regulatory milestones and their implications for the banking sector:

| Date | Regulatory Milestone | Implication for Banks |

|---|---|---|

| Feb 9, 2024 | Distributed Ledger Tech: Enhancing Regulatory Approach | Banks encouraged to adopt blockchain for compliance |

| Oct 30, 2023 | Executive Order No. 14110 | Reinforces existing laws’ applicability to blockchain use |

The future of blockchain in financial services will be shaped by these regulatory changes, which aim to foster innovation while safeguarding the financial ecosystem.

Conclusion

The exploration of blockchain technology in the banking and financial services sectors has unveiled significant advancements that promise to reshape the industry. As we have seen, blockchain’s potential to streamline P2P payments, enhance trading, and improve regulatory compliance, among other applications, is driving a transformative wave across financial institutions. The shift towards digital currencies and the adoption of blockchain solutions are not only reducing transaction costs and speeding up processes but also addressing long-standing challenges such as dependency on centralized systems, lack of trustability, and higher operational costs. The research and case studies discussed underscore the urgency for both established banks and fintech startups to adapt to this technological revolution. As the financial landscape continues to evolve, blockchain stands as a pivotal innovation, heralding a new era of efficiency, security, and trust in financial services.

Frequently Asked Questions

How is blockchain technology revolutionizing banking and P2P payments?

Blockchain is addressing inefficiencies in banking by reducing bureaucracy and enhancing the clearing and settlement processes. It enables faster, more secure, and direct P2P payments, bypassing traditional banking systems.

What are the benefits of financial institutions adopting digital currencies?

Financial institutions are exploring digital currencies due to benefits such as lower transaction costs, faster transaction speeds, and the potential to streamline operations across the global financial landscape.

What does current research say about blockchain’s future in finance?

Current research, including bibliometric analyses, indicates a growing trend in blockchain applications in finance, predicting significant impacts on the future of banking, cryptocurrency, and regulatory compliance.

How is blockchain technology enhancing regulatory compliance in finance?

Blockchain’s distributed ledger technology offers improved transparency and traceability, which can help financial institutions meet regulatory requirements more efficiently and with better audit trails.

What role does blockchain play in trade finance and supply chain finance?

In trade finance, blockchain facilitates faster transactions, reduces counterparty risks, and improves transparency. In supply chain finance, it enables innovations that enhance transaction security and efficiency.

What are some emerging financial models enabled by blockchain technology?

Blockchain has given rise to new financial models such as crypto lending platforms, blockchain-based crowdfunding, and digital identity verification systems, which are transforming the fintech industry.